As the end of the year approaches, Wall Street's major banks intensively release their macroeconomic outlook for 2023, and Goldman Sachs is no exception.

In the report released last week by Goldman Sachs strategist Dominic Wilson and others, they listed ten macro and market themes that will dominate the investment pattern in 2023, including inflation, economic recession, interest rate increase, global major asset trends and other topics of concern.

Among the top five themes, Goldman Sachs said that, The Federal Reserve will start to slow down the pace of interest rate increase before 2023, but will extend its interest rate increase cycle. In the process, the US economy showed "sustained resilience" and could avoid falling into a full recession. Once the United States falls into a full recession, the S&P 500 index may drop to 2900 as low as possible. As other central banks are unable to keep up with the pace of the Federal Reserve's interest rate increase, the US dollar still has room to rise next year 。

In contrast, Goldman Sachs is more pessimistic about the European economy, saying that under complex factors, Europe may be heading for a full recession.

This is the first part. Follow up Wall Street news will sort out the last five themes. Please pay attention.

1、 How wide is the US "soft landing" path?

Goldman Sachs' core forecast shows that inflation in the United States will cool down "slowly" but "continuously" in 2023, and the economy will avoid falling into recession. Goldman Sachs believes that the US economy still shows greater resilience than the market's usual expectations in the case of the Federal Reserve's continued aggressive interest rate hikes. The bank wrote in the report:

The super loose monetary policy and fiscal policy at the beginning of the epidemic, the healthy balance sheet of the private sector and the positive impact of the normalization in the post epidemic era, all of which, in combination, enhance the ability of (the economy) to absorb rising policy interest rates.

Impact of Russia Ukraine conflict on global commodity market Is bound to plunge Europe into recession in the coming months But for the United States, which is much less affected, We believe that although the path of soft landing is narrow, it is still possible, because the distortions (factors) related to the epidemic will eventually subside in 2023.

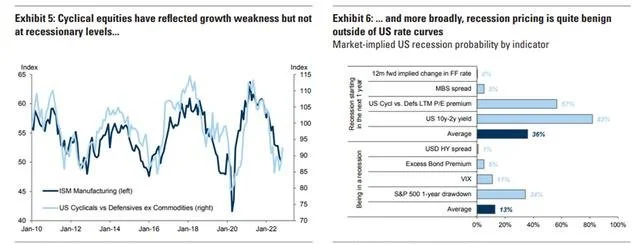

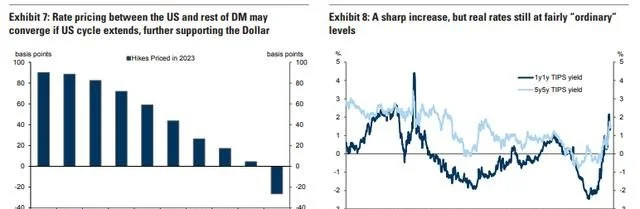

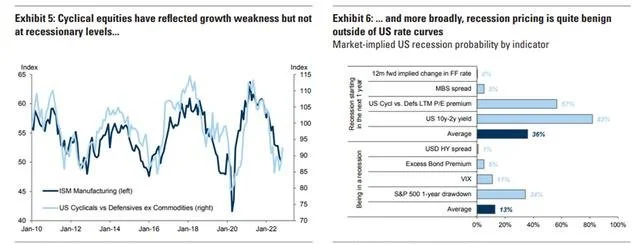

This core path now seems to be well reflected in the asset market, especially after the stock price trend in the first half of November. Since the summer, cyclical stocks have outperformed the market, credit spreads have tightened, and the interest rate curve in 2023 is less inverted than before.

In fact, Goldman Sachs believes that investors may have underestimated The affordability of the US economy to the tightening policy and the extension of the interest rate increase cycle The negative impact of this pessimism offset the positive impact of real income growth and fiscal slowdown.

At the same time, Goldman Sachs warned that there was still uncertainty about whether inflation would slow down sufficiently in the future and whether the US economy could avoid recession in the process. At present, the market only pricing "partial recession risk" Therefore, even after a year of concern, the market is still vulnerable to the news of slowing growth and rising inflation.

2、 Cyclical conditions may dominate the market trend next year

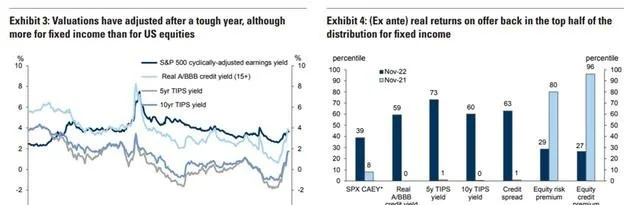

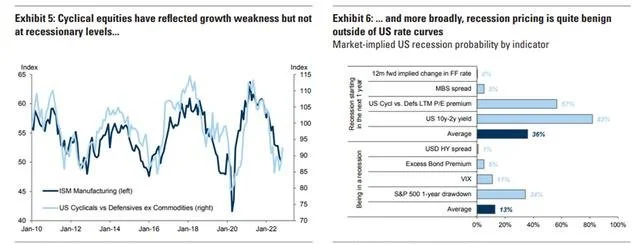

Goldman Sachs said that the US labor market has begun to rebalance, and the recent report shows that US inflation may start to slow down. These changes are crucial for the Federal Reserve to slow down the pace of interest rate increases. This is also popular in the market. As the mood improves, Asset valuation has improved significantly.

A year ago, the actual expected returns of US stocks and fixed income assets fell to historical lows. But now, in one of the worst periods on record for balanced portfolios, On the whole, the real return rate of fixed income assets in the United States bucked the trend and returned to the top half of the 25 year trend, as is generally the case for non-U.S. stocks.

The US stock market is still a partial exception - although its valuation has shrunk, it is not as good as other long-term assets. Compared with national debt, corporate debt and the macro environment, the US stock market has performed quite well.

The relative valuations of many emerging market assets are not as compelling as they were a few months ago.

Goldman Sachs believes that, Cyclical conditions will dominate in the future, but they are still unclear. Recently, the market has become more worried about the rise of interest rates, the strength of the US dollar and the decline of the stock market. In addition, the trend of economic growth has not yet been determined. Therefore, The longer the market's optimism lasts, the more likely it will prove to be "premature".

The valuation of some assets (non G10 currencies against the US dollar, some non US stocks, etc.) has fallen to an attractive level, indicating that the trend of (US assets) may be more volatile.

Because of the good news on inflation, there may be some room for the US stock market to rise in the short term, but for most stocks, the valuation is not so cheap, and the pricing of macro risks is not so reasonable, which is enough to provide a solid buffer for the downward trend.

Comprehensive consideration of valuation and cyclical risk, US stocks may continue to weaken: avoiding recession may limit the downward space of (US stocks), but the upward space of (economic) growth may also be limited by the prospect of further tightening policies of the Federal Reserve.

3、 The probability of recession in the United States is still one third, and that in Europe is likely to lead to overall recession

Goldman Sachs predicted that although the United States could avoid a complete recession In view of the fact that the interest rate raising cycle of the Federal Reserve has not yet ended, there is still a 35% probability of recession in the next 12 months.

The biggest risk comes from continued monetary tightening. The impact of deflation on the economy is lagging behind, and sustained inflation may make the Federal Reserve realize that it is necessary to take more radical measures to slow economic growth.

Higher interest rates may also bring risks from other aspects. For example, there are downside risks in the real estate market. Over time, in areas where decisions are based on much lower interest rate discussions (private equity and credit; leveraged loans), the non bank financial system may experience pressure, as in the UK pension fund and virtual currency areas where LDI investment strategies are used.

Goldman Sachs said that the market has priced some recessions, If the United States falls into a full recession, the S&P 500 index may fall to 2900-3500 points. The S&P 500 index still has 12% - 28% decline space according to the level of the overnight US stock market closing at 4003.58. Goldman Sachs said:

These concerns are widely recognized, so the market has only priced the recession risk of many assets to a certain extent. This is especially true of the US interest rate curve (including the Federal Reserve's pricing after the middle of 2023), which is part of the reason why the interest rate curve remains firmly inverted.

Cyclical stocks have underperformed this year, and stock volatility is also higher than the level usually proved by spot macro data. But across a wide range of assets, our benchmark tests generally show that, Even if it is a standard recession, most markets are still far from pricing it as a basic scenario, and a more serious recession has a long way to go.

In Goldman Sachs' eyes, economies outside the United States look more vulnerable. In Europe in particular, most countries are heading for a comprehensive recession, mainly because the situation facing Europe is more complex and difficult.

The first is the number one problem - natural gas supply. Since the outbreak of the conflict between Russia and Ukraine, energy prices have soared, forcing many energy intensive enterprises in Europe to cut production or even transfer production capacity, which has intensified people's concern about "deindustrialization" in Europe.

Second, Europe is facing the double risks of high inflation and economic recession. The inflation data of the euro zone in October rose to a record 10.7% year on year, which is more than five times the target of the central bank. In addition, PMI has fallen below the boom and bust line, exacerbating concerns about economic recession. Nevertheless, the European Central Bank still insists on putting curbing inflation first and may continue to raise interest rates significantly in December.

With the rise of interest rates and the decline of the economy, the debt problems of Italy and other peripheral countries in the euro area have become apparent again. However, this risk may be underestimated by the market as the interest margin of Eurozone bonds further narrows.

In addition, global geopolitical risks are currently higher than normal, which makes the supply of bulk commodities more vulnerable to interference.

Goldman Sachs concluded:

In general, the recession risk of countries other than the United States is also more clearly reflected in market pricing. For example, European investment grade corporate bonds have adequately priced the economic downturn, and we believe that it is one of the most attractive assets in developed markets. But by contrast, The trading of bonds of (Europe) peripheral countries is relatively active compared with the fundamentals, and there may still be huge downward space in the case of more difficult economic prospects.

4、 How long will it take for the interest rate to return to "normal"?

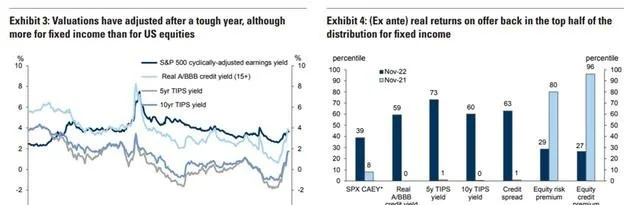

After a series of radical interest rate hikes, most major central banks tend to increase interest rates gradually. Goldman Sachs believes that the Federal Reserve will start to slow down the pace of interest rate increase before 2023, making it enter the stage of "ordinary" monetary tightening policy. However, the Federal Reserve may extend the interest rate raising cycle and raise the peak interest rate, which means that the return of interest rates to "normal" may take a longer time. Goldman Sachs wrote in its report:

Although our predicted peak interest rate of 5.0-5.25% is close to the current market pricing, we believe that as long as the economy avoids recession, the Federal Reserve will easily continue to gradually increase interest rates in 2023.

Partly because the unemployment rate is still very low and the core inflation rate is far higher than the target, it is difficult for the Federal Reserve to completely stop tightening policy. In addition, the Federal Reserve's suspension of interest rate hikes during non recession periods may ease the financial situation. Therefore, if the Federal Reserve wants to maintain a tight situation and keep inflation on a downward track, it may need to further gradually raise interest rates.

And the market has begun to price this possibility, Based on the prediction that the US economy has "sustained resilience", the market will continue to maintain this pricing, and long-term (neutral) interest rates may also rise.

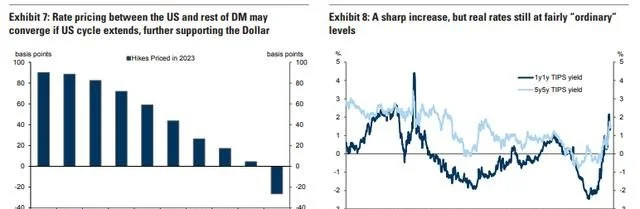

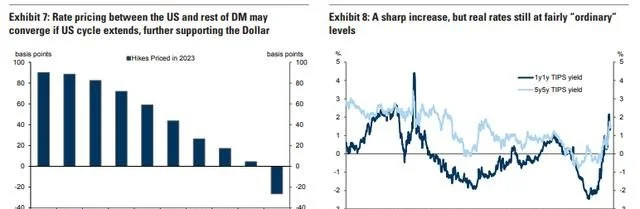

As for the return of interest rates of other central banks, Goldman Sachs pointed out that since the Federal Reserve has gone farther and faster than other central banks in raising interest rates, the market expects that the policy interest rate growth in Europe and Australia will be much higher than that in the United States in 2023.

But Goldman Sachs believes that countries outside the United States face higher recession risks, such as Australia, New Zealand, Canada and the United Kingdom, while most of Europe is heading for a full recession, which also puts pressure on further interest rate increases. Japan is special, Goldman Sachs estimates The Bank of Japan will continue to adhere to the yield curve control policy (YCC), even after the end of the term of the Japanese governor, Tohiko Kuroda.

In short, Goldman Sachs believes that a "resilient" economy will help real interest rates gradually rise. In this sense, the current performance of the asset market may be opposite to the previous cycle to some extent. Then, facing the risk of deleveraging and tightening, major economies are even difficult to achieve trend growth, and inflation continues to fall below the target.

5、 Will the US dollar dominate next year?

Goldman Sachs said, The Federal Reserve still does not have the conditions to continue to turn. As interest rates continue to rise, the dollar is still further strengthened, up about 3%. According to the closing price of 106.68 on the 17th day of the report release, the dollar index is expected to rise to 110. Goldman Sachs said:

Facts have proved that American activities and the labor market are flexible. In our model path, the American economy is likely to avoid recession. However, growing financial stability, mortgage markets and recession concerns in many other parts of the world mean that other global central banks may find it difficult to keep pace with the Federal Reserve.

At the same time, inflation risks in other regions help protect the purchasing power of the United States against other currencies.

If recession fears spread or financial stability risks become a reality, this may also increase the upside of the US dollar, because the US dollar, as the world's largest reserve currency, has a hedging appeal.

However, Goldman Sachs added that, As inflation is still at a high level, and more and more countries have launched a "local currency" defense war, there is little room for the dollar to rise, and the degree of volatility is increasing.

It is always difficult to seize the opportunity to turn. In recent decades, the peak of the US dollar usually coincides with the trough of economic activity, the strengthening of the stock market and the easing policy of the Federal Reserve—— We don't think that will happen in a few quarters.